Take control of your financial future with Kehidupan Finansial Apk, the best tool for managing your money. Whether you want to achieve financial goals or get rid of money worries, this app is the best choice for you. With an easy-to-use interface and intuitive tracking features, managing and tracking your daily money has never been easier.

With the App, you can easily record and plan transactions on all your devices, be it your phone, tablet, or laptop. Now you don't have to worry about losing data when you switch devices because our app syncs all your information.

Plan and budget with confidence and cut costs wherever possible. Stay in control of your money by getting real-time alerts when your budget is tight. Our clear, easy-to-understand icons make it easy to see costs at a glance, and custom payments give you the flexibility to customize the app to suit your needs.

Check out this app for everyone:

- 1. Register or schedule a transaction on your phone, tablet, or laptop. We sync everything to your device automatically.

- 2. After registering an account, you can save your precious data anytime, anywhere, and you don't have to worry about data loss when you switch phones.

- 3. Plan your budget and cut out unnecessary parts. Receive instant notifications when your budget hits a preset limit.

- 4. Clear icons help you in quick cost analysis and also support custom billing.

About Kehidupan Finansial Apk

Kehidupan Finansial Apk is an important skill that everyone should have. A healthy financial life allows us to meet our daily needs, plan for the future, and achieve long-term financial goals. In today's digital age, there are many financial apps that can help us manage our finances efficiently. This article explains the importance of using financial apps to manage your financial life.

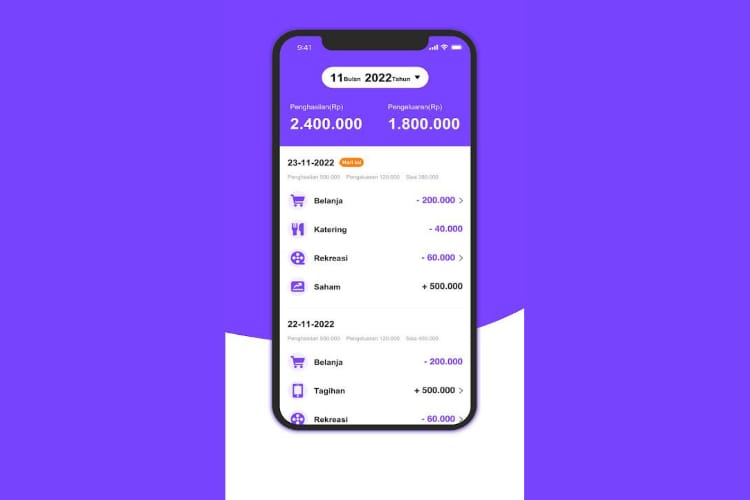

Firstly, using finance apps can help us track and manage our daily expenses. Thanks to the expense tracking feature, we can easily see what our money is actually being spent on. The app can organize accurate financial reports based on spending categories so we can easily assess our spending habits and take action to manage our budget more effectively.

In addition, it can help you create and manage a monthly budget. By setting a spending limit for each category, the app will notify you when you reach or exceed that limit. It helps us control spending, avoid excessive debt, and meet long-term savings or investment goals.

It can help you plan for long-term financial goals. We can set goals, like buying a home, paying off debt, or saving for retirement, and apps help us plan the steps we need to take to reach those goals. The app can also make investment recommendations based on your risk profile and financial goals, allowing you to wisely manage your funds and maximize your long-term wealth.

In addition to the above features, finance apps provide frequent bill payment reminders, detailed financial reports, and visual charts to see your overall financial progress. By using financial apps, we can monitor our financial situation in real-time, make better decisions and achieve greater financial stability. However, choosing a reliable and secure financial application is important.

Be sure to read reviews, check privacy policies, and understand the features offered before committing to any particular app. Also, follow good financial management habits, e.g. B. Keeping important financial records, setting aside an emergency fund, and seeking professional financial advice when needed. In the digital age, managing your Kehidupan Finansial Apk using financial apps can be a very useful tool for financial health. By using this app wisely, we can manage our budget more efficiently.

Kehidupan Finansial Apk Features

Tracking fee- With Kehidupan Financial APK you can easily and quickly track your expenses. You can organize your expenses into different categories, track your transactions, and view detailed expense reports. By monitoring your spending, you can learn a lot about how you're spending your money and where you need to make changes to meet your financial goals.

Budget tool- The app's budgeting tools allow you to create a budget based on your income, expenses, and financial goals. You can see how much you can spend in different areas, track your progress and get notifications when you reach or exceed your spending limit. Using Kehidupan Financial APK for budgeting will help you prioritize your expenses, reduce unnecessary expenses and achieve your financial goals.

Goal Setting and Monitoring- Kehidupan Financial APK allows you to set financial goals and track your progress toward them. Whether you're saving for a trip, a new car, or an emergency fund, the app helps you stay focused and on track. You can set goals for how much you want to save, track how much you're saving, and celebrate milestones as you get closer to your financial goals.

Look at the money- With Kehidupan Financial APK you can learn important things about your financial health. The app gives you charts and logs of how you spend your money, how your income changes over time, and how you save. These facts will help you make wise decisions about your money, identify areas for improvement, and adjust your plans accordingly.

Safe and personal- Kehidupan Financial APK keeps your financial information safe and private. The application uses encryption and security protocols to protect your data. You can also set up a personal password or biometric authentication with the app to ensure only you can access your banking information.

Additional Features

- Calculate bank loan/bank loan simulation (unsecured loan).

- Calculate motorcycle loan/motorcycle loan simulation

- Calculate car loan/car loan simulation

- Calculate real estate loan / real estate loan simulation

- Fixed deposit calculation / fixed deposit simulation

- Credit data is displayed in the table

- Export spreadsheets to Excel and PDF

- Save calculations in the favorites menu!

- Built-in calculator

- Double discount calculator (example: 20% + 30%)

- Percent calculator

- Currency conversion calculator (updated according to World Bank)

- Unit conversion calculator (weight, temperature, distance, speed, etc.)

- Password generator

- Set the home page view to your liking (grid/list).

- Set the thousands and decimal separator to your liking

- Adjust the number of decimal places to your liking

Financial independence is not just about retiring early:

Kehidupan Finansial Apk is the state where you can achieve your dreams without worrying about your financial situation. Many people associate financial independence with early retirement. However, this is one of the things you can achieve when you have financial freedom. Your other dreams, be it traveling abroad, building a dream home, ensuring a better life for your family, or gaining financial independence can also be realized.

That's the interesting thing about financial freedom. Financial independence encompasses many things in life, not just retirement, which is really just a part of your finances. It is actually closely related to the values and goals you want to achieve in life.

In other words, when you are financially free, you can take “time” to achieve your dreams. Imagine being able to say, every time you wake up in the morning. Yes, financial independence means managing money and consolidating it for a life of doing and can leave what you want. When you want, with whom you want, where you want, and for as long as you want.

You could say that financial freedom means unlimited flexibility to enjoy the life you want. Financial independence takes over your life and becomes the only "captain" that defines your desired purpose in life. Sounds amazing doesn't it? What's even more exciting is that everyone has the opportunity to achieve financial freedom, even those of you who earn very little!

Kehidupan Finansial App can feel great. Especially when you realize you're just a normal person. If a modest income, a portfolio of proven investments -- or none at all, even if you "dig, patch the hole" each month -- can lead to financial freedom in the future, it seems unlikely.

Types of Fintech in Indonesia:

The growth of fintech in Indonesia has resulted in various fintech products aimed at enhancing financial assets and sustaining people's lives. There are types of fintech that are currently experiencing rapid growth, including:

1. Peer-to-Peer (P2P) Lending Services.

This type provides credit funds to meet business needs or capital. Fintech is often used to give traders quick access to capital. However, be careful! Do not get scammed by illegal fintech like unofficial online lending that can harm consumers.

2. Crowdfunding.

This type of fintech connects the needy and donors with guaranteed safe and easy transactions. Crowdfunding not only serves to collect donations/contributions but also to search for investors and entrepreneurs.

3. Electronic wallet.

This is the type of fintech that we often come across today, namely digital wallets whose mission is to provide electronic money storage to their users. It aims to make it easier for users to withdraw funds for transactions on marketplaces, merchant apps, etc.

4. Payment Gateway.

A payment gateway is a fintech system that authorizes payments through online transactions. Friends, the real example you will come across is PayPal.

5. Investment.

In addition to digital wallets, fintech is also in demand on the market today. Due to the rapid development of technology, many investment tools have switched to online applications for investors to invest their capital easily.

6. Digital Bank.

The last type of fintech to grow recently is digital banking, meaning banks where 100% of transactions are processed digitally, from account registration to wealth management. That said, this digital bank differs from mobile banking, because in transactions, m-banking always works with offline banking, while digital banks do 100% electronic transactions!

7 finance apps for families:

If you're shy about journaling and want to keep financial records close at hand, there's a wonderful selection of smartphone apps to help you with that. Check out the list!

Money lover

The first is a money management app called Money Lover. The app is used by 5 million smartphone users as a personal assistant for financial documents. This app offers several interesting features including:

- Expense and Income Recorder

- Track and record customer accounts

- financial chart

- Linked directly to the bank account

- Scan receipts

- Capture recurring expenses for monthly bills

- Set a budget to achieve your goals

- Save according to your financial goals

- Export to a CSV or Excel file

If you are good at keeping financial records, there is a premium version of the Money Lover account with more comprehensive features that will make you the best financial management teacher. Also, in this app, you can organize your financial records by category, making it easier to track your expenses

How to download and install Kehidupan Finansial Apk?

This unique property ensures that its users are always protected. If you cannot find this app in the Google Play Store, you can always download it from this website. Follow the steps below to install this app on Android devices before completing the idea.

- Go to "Unknown Sources" in Settings. After that, go to Security and enable the Security option.

- Go to the download manager of your Android device and click on Kehidupan Finansial. Now it's time for you to download it.

- Two options can be found on the mobile screen. There are two ways to install an operating system and all you have to do is boot it quickly on your Android device.

- You will see a popup with options on your mobile screen. You have to wait a while for it to appear.

- When all downloads and installations are complete, just click the "Open" option and open the screen on your mobile device.

Conclusion

This review must have fulfilled all your queries about Kehidupan Finansial Apk, now download this amazing app for Android & PC and enjoy it. Apkresult is a safe source to download APK files and has almost all apps from all genres and categories.