IHiram Loan APK is a fast and convenient loan app tailored to various financial needs, be it emergencies, bill payments, urgent purchases, or personal goals. We offer reliable credit services according to your needs. It is the most comprehensive Umrah e-marketplace app in the Republic.

IHiram Loan is an application that combines an electronic marketplace, news content, social media, and utilities for Umrah and Hajj pilgrims. Users can now order and pay for Umrah packages directly on the Ihram App. Various Umrah package deals are available at affordable prices and discounts/cashback from various partner travel agencies certified by the Ministry of Religion of the Republic of Indonesia.

Every booking transaction from Umrah to Ihram is guaranteed to be safe as Republica offers a shared account through which the travel agent is paid only after the trip is completed. Users can get comprehensive information about the process of the Umrah/Hajj pilgrimage and interact with other pilgrims through friend and forum features. In short, pilgrims no longer have to feel “alone” in the Holy Land.

About IHiram Loan APK

IHiram Loan APK is a free financial app that works in the Philippines. This online lending platform allows you to borrow with flexible amounts and flexible payment terms. Since the fintech company behind the project is properly registered with the local government, you can be sure that the funds will be distributed as agreed. As far as apps go, the App doesn't exactly explore the online lending space in the Philippines. However, it encourages continued use of the platform through enhanced features and benefits.

New users can borrow up to PHP 10,000, or about $200, and pay it back within 91 days. In practice, you will have to specify the required amount and the number of installments that you want to repay later. Like other loan apps, it requires a tedious registration and verification process. The app uses a simple orange-and-white color palette reminiscent of the Shopee platform. Users are also required to fill out several verification fields, provide personal information, and submit documents online. The loan section is kept simple and has a separate section for personal loan options. Interestingly, it includes an in-app points system that rewards users when they increase their limit.

It has the same limitations as other loan apps. First, the customer service portion of the app rarely, if ever, works. Users complain about not receiving technical support when they need it. Another and more worrying disadvantage of this platform is that it constantly contacts you if you pay late.

Features of IHiram Loan APK

Intuitive interface. For new users who register on the Hero Fincorp Personal Loan app, navigation is easy at every step. It ensures that the registration process is completed correctly.

Paperless documents. No physical documents are required during registration. Verification is done using KYC details and proof of income is submitted online.

Loan without collateral. IHiram Loan APK does not require any guarantee or guarantor. People who meet the eligibility criteria will receive quick loans.

Small money loan. Meet your immediate financial needs with an instant loan of Rs 50,000 up to Rs 3 lakh from Hero Fincorp.

Low interest rates. The interest rate primarily influences the loan amount. Hero Fincorp offers low interest rates starting at 12.5% on monthly outstanding EMIs.

Fast delivery. After verifying the registered details, the loan will be approved within a few minutes. The immediate payment is made directly to the borrower's bank account.

There are no hidden costs.At no time will additional fees be charged. This is one of the most common disadvantages of personal loans and other types of loans.

Highlights of IHiram Loan APK

Data protection: Your data will be strictly protected and treated confidentially.

Types of Loans: Online loans are available anytime, anywhere for various financial needs including personal expenses, accommodation, and travel.

Convenient operation: Real-time monitoring of loan progress and reminders of repayment deadlines.

Unsecured Loan: No guarantee fee or commission.

Flexible Line of Credit: A revolving line of credit up to ₱30,000. Borrow again immediately after repayment.

Product details:

- Loan Amount: ₱5,000 – ₱30,000

- Loan term: 92 to 180 days

- Maximum annual interest rate: 10-20%

- Service Fee: Up to 3%

- Example of a loan:

- For example, if you borrow ₱10,000 for 180 days at an annual interest rate of 15%:

- Interest: 15% * ₱10,000 / 365 * 180 = ₱740

- Commission: 3% * ₱10,000 = ₱300

- Total refund amount: ₱10,000 + ₱300 + ₱740 = ₱11,040.

Benefits of Ihram:

- Simple application process

- Convenient online application

- Instant cash loan

- Easy approval

Loan process:

- Enter your personal information and create an account.

- Complete the loan application by selecting the loan amount and term.

- Submit your application for review and wait for the results.

- Once approved, the loan will be credited to your bank account.

- To apply for an IHiram Loan APK, applicants must have:

- A valid identification document

- Filipino citizenship

- Age 20 to 60 years

- A valid Philippine mobile phone number and bank account.

Loan repayment:

You can repay the loan through various methods including online banking, mobile banking, ATM transfer, etc. IHiram Loan APK allows early repayment of loans.

Product presentation:

- Age: Over 18 years

- Loan Amount: ₱2,000.00 – ₱12,000.00

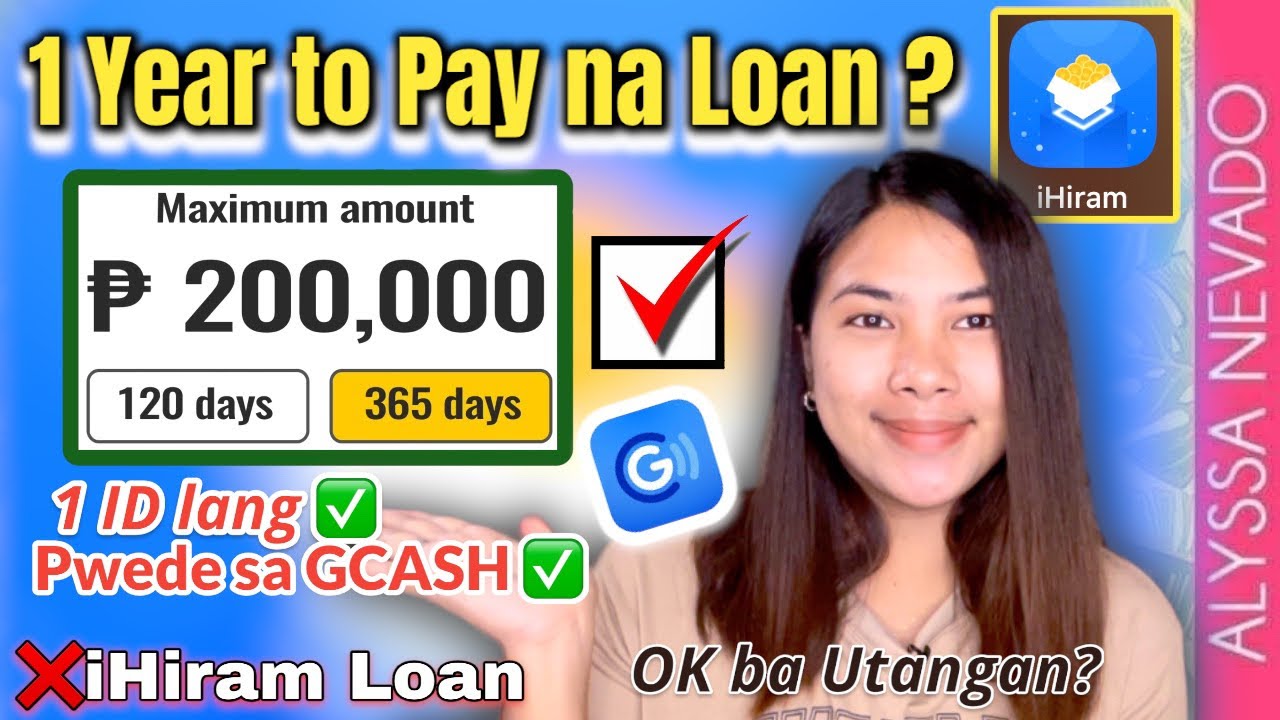

- Loan term: 91 days (minimum with extension period) – 365 days (maximum with extension period)

- Management fee: 0

- Loan interest rate: The maximum APR is 18% per year, 0.05% per day

- Example: If you choose a credit limit of ₱6,000.00 with a term of 180 days,

Total Interest Payable: ₱6,000.00 * 0.05% * 180 = ₱540.00, Interest Payable Monthly: ₱6,000.00 * 0.05% * 30 = ₱90.00, 6 Interest is paid in monthly repayments and Payments paid. 000.00/6 + ₱ 90.00 = ₱ 1,090.00, the entire refund will be charged with principal and interest: ₱ 6,000.00 + ₱ 540.00 = ₱ 6,540.00.

Why choose IHiram Loan APK?

Fast Payout: Get your money within 24 hours of loan approval.

Easy application: Complete your request in just a few steps on your mobile service.

Easy documentation: The app only requires your bank account and ID. Asks for provision

Higher Amount: With a good repayment history, your credit limit increases and you can eventually reach a maximum amount of PHP 12,000. Longer terms can also be omitted if payment is made early.

Fast response: Not only do we process your request in real time, but we are also there for you six days a week.

How to download and install the IHiram Loan APK?

This unique property ensures that its users are always protected. If you cannot find this app in the Google Play Store, you can always download it from this website. Follow the steps below to install this app on Android devices before completing the idea.

- Go to "Unknown Sources" in Settings. After that, go to Security and enable the Security option.

- Go to the download manager of your Android device and click on IHiram Loan. Now it's time for you to download it.

- Two options can be found on the mobile screen. There are two ways to install an operating system and all you have to do is boot it quickly on your Android device.

- You will see a popup with options on your mobile screen. You have to wait a while for it to appear.

- When all downloads and installations are complete, just click the "Open" option and open the screen on your mobile device.

Conclusion

This review must have fulfilled all your queries about the IHiram Loan APK, download this amazing app for Android & PC and enjoy it. Apkresult is a safe source to download APK files and has almost all apps from all genres and categories.